Unlocking the World of Proprietary Trading Strategies

The financial markets are a bustling arena where skilled traders thrive and innovative strategies reign supreme. Among these strategies, proprietary trading strategies stand out as some of the most sophisticated and effective methods utilized by trading firms to gain an edge in the market. This article delves deeply into the mechanics, benefits, and intricacies of proprietary trading strategies, providing a comprehensive resource for anyone looking to understand this fascinating field.

Understanding Proprietary Trading

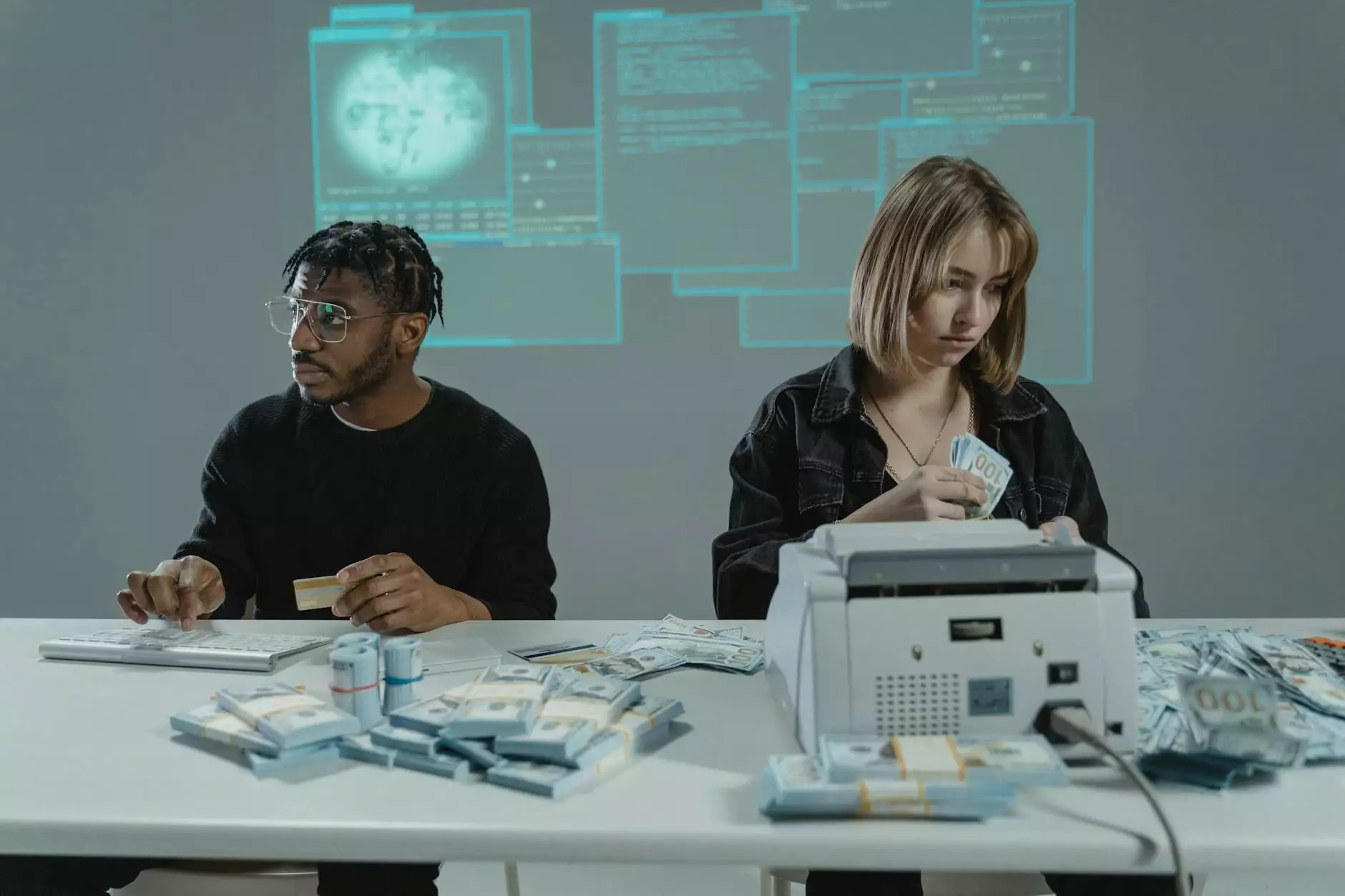

Proprietary trading, often referred to as prop trading, is when a financial firm or an individual trader invests for its own gain rather than on behalf of clients. In this model, companies use their own capital and balance sheet to trade financial instruments, such as stocks, bonds, currencies, and derivatives. This direct involvement allows firms to reap the rewards of successful trades while also shouldering the associated risks.

The Role of Proprietary Trading Firms

Proprietary trading firms play a pivotal role in enhancing market efficiency. They engage in various activities, including market-making, arbitrage, and utilizing advanced proprietary trading strategies to capitalize on market inefficiencies. Here are a few key characteristics of these firms:

- Risk Management: These firms often implement rigorous risk management practices to mitigate potential losses.

- Advanced Technology: Proprietary trading often leverages cutting-edge technology, including algorithmic trading and high-frequency trading systems.

- Trained Analysts and Traders: Many prop trading firms employ highly skilled analysts and traders who specialize in identifying profitable opportunities.

Components of Proprietary Trading Strategies

Proprietary trading strategies are diverse and can be tailored based on various factors, including market conditions, asset classes, and individual trader expertise. The following components are essential in formulating effective proprietary trading strategies:

Market Analysis

Understanding market behavior is crucial for developing proprietary trading strategies. Traders often utilize various analytical techniques, including:

- Technical Analysis: Focusing on price patterns, trends, and various indicators to forecast future price movements.

- Fundamental Analysis: Evaluating the financial health of companies or economic indicators to make informed trading decisions.

- Sentiment Analysis: Gauging market sentiment and investor psychology to predict short-term price movements.

Algorithmic Trading

Many proprietary trading firms employ algorithmic trading to execute their strategies. This involves using algorithms to automate trading decisions and executions based on pre-defined criteria. The benefits of algorithmic trading include:

- Speed: Algorithms can execute trades within milliseconds, seizing opportunities that may vanish in moments.

- Elimination of Emotions: Algorithmic systems make trades based on numbers, removing emotional biases from trading decisions.

- Consistent Execution: Algorithms can consistently execute a defined strategy without the fatigue or inconsistency of human traders.

Risk Management and Position Sizing

Effective risk management is foundational for any successful trading strategy. Proprietary traders often use sophisticated techniques to manage risks, such as:

- Diversification: Spreading investments across various assets to mitigate risk.

- Hedging: Using financial instruments to offset potential losses in investments.

- Position Sizing: Determining the appropriate amount to invest in a trade based on risk tolerance and market conditions.

Types of Proprietary Trading Strategies

Different types of proprietary trading strategies can be employed depending on market conditions and desired outcomes. Here are several common strategies:

1. Arbitrage Trading

Arbitrage trading involves simultaneously buying and selling an asset in different markets to exploit price discrepancies. This strategy relies on rapid execution and precision, often facilitated by automated systems. Traders can capitalize on minor price differentials, leading to consistent, albeit small, profits.

2. Market Making

Market makers provide liquidity to the markets by continuously quoting buy and sell prices for a particular asset. They profit from the bid-ask spread—the difference between the buying price and the selling price. This strategy plays a vital role in ensuring market liquidity and can be highly profitable in volatile markets.

3. Trend Following

Trend following is a strategic approach where traders identify and follow market trends. By analyzing historical data and employing technical indicators, traders aim to enter positions in the direction of prevailing trends, maximizing potential returns. This strategy requires a disciplined approach and the ability to adapt quickly to changing market conditions.

4. High-Frequency Trading (HFT)

High-frequency trading involves executing a large number of trades at extremely high speeds. Utilizing powerful algorithms, HFT traders can exploit small price fluctuations across various markets. This strategy requires sophisticated technology and a deep understanding of market microstructures, making it suitable for advanced trading firms.

The Benefits of Proprietary Trading Strategies

Implementing proprietary trading strategies offers several unique advantages for firms and individual traders:

Enhanced Profit Opportunities

By using proprietary strategies, traders can access a myriad of trading opportunities that may not be available to traditional retail investors. This access to a range of strategies enables firms to maximize their profit potential in different market conditions.

Increased Market Efficiency

Proprietary trading firms contribute to overall market efficiency by providing liquidity and narrowing bid-ask spreads. Their trading activities help reflect fair market prices, which is beneficial for the entire financial ecosystem.

Flexibility and Adaptability

One of the key advantages of proprietary trading is the ability to adapt strategies based on real-time market data. Traders can modify their approaches quickly in response to changing conditions, allowing them to seize opportunities that may arise unexpectedly.

Regulations and Challenges Facing Proprietary Trading

While proprietary trading can be highly lucrative, it is not without its challenges, particularly in terms of regulation. Regulatory bodies closely monitor and scrutinize prop trading activities to prevent market manipulation and ensure fair practices. Here are some key regulatory considerations:

- Compliance: Firms must comply with various regulations, such as the Volcker Rule, which restricts certain types of proprietary trading by banks.

- Reporting Requirements: Prop firms are often subject to extensive reporting requirements to ensure transparency in their trading activities.

- Market Regulations: Adhering to the regulations set forth by financial authorities is essential to maintain market integrity and investor trust.

Conclusion: The Future of Proprietary Trading Strategies

As technology continues to evolve, the landscape of proprietary trading strategies will likely undergo significant changes. Innovations in artificial intelligence and machine learning are set to redefine the capabilities of traders, enabling them to develop increasingly sophisticated trading algorithms.

In conclusion, proprietary trading strategies represent a dynamic and ever-evolving field within financial markets, providing avenues for enhanced profits and market efficiency. Understanding these strategies can empower traders and investors alike, allowing them to navigate the complexities of the financial world with greater confidence and skill. As the industry continues to adapt, the possibilities for growth and innovation remain boundless, making this an exciting time for those involved in proprietary trading.